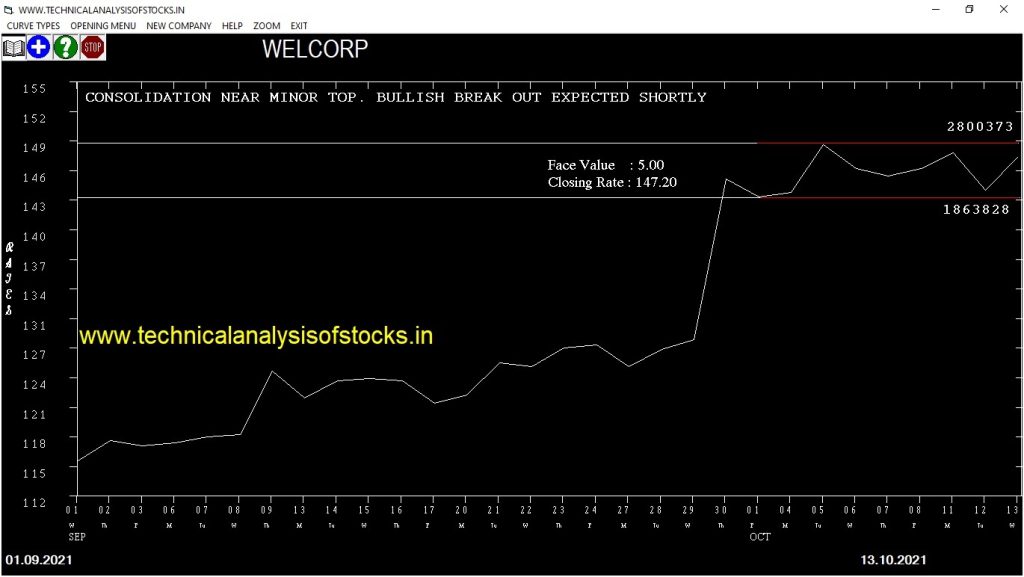

BUY WELCORP (NSE Symbol) Buy@ 150.05 or Above after cooling period SIGNAL : CONSOLIDATION NEAR MINOR TOP. BULLISH BREAK OUT EXPECTED SHORTLY. Stop Loss : 135.20 Target : 162.50 (Short term)

HOT BUZZING STOCKS (14.10.2021)

NSE SYMBOL CLOSING RATE

ARVIND 127.55

TATAMTRDVR 237.45

BORORENEW 431.25

WEIZMANIND 64.40

BSL 89.25

NEULANDLAB 1736.60

SANGAMIND 201.60

SHARDAMOTR 658.45

GDL 274.60

GULPOLY 300.05

NDL 75.75

PFOCUS 83.15

PRIMESECU 110.55

TI 48.35

TTML 50.50

ZENTEC 215.80

AXISCADES 86.45

KOPRAN 204.30

ADANIPOWER 106.70

ALMONDZ 122.45

VINEETLAB 83.60

KOTHARIPRO 109.10

OMAXAUTO 47.75

ASAL 81.75

TALBROAUTO 293.65

BCG 81.60

GENESYS 291.15

PRAXIS 44.70

TERASOFT 53.25

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| POWERGRID (F&O) | 161113 | 196.30 | 199.40 | 1.55 |

| KALPATPOWR | 23313 | 422.40 | 433.55 | 2.57 |

| AMRUTANJAN | 48746 | 862.00 | 884.85 | 2.58 |

| PNCINFRA | 24400 | 379.90 | 391.35 | 2.93 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| SEQUENT | 31866 | 225.00 | 206.74 | 240.13 | 221.90 | 221.95 | -0.02 |

| COCHINSHIP | 15395 | 375.39 | 351.74 | 394.82 | 374.30 | 374.50 | -0.05 |

| AUROPHARMA (F&O) | 61452 | 729.00 | 695.99 | 755.87 | 728.55 | 733.95 | -0.74 |

| REPCOHOME | 16266 | 328.52 | 306.40 | 346.72 | 326.85 | 329.40 | -0.78 |

| HAL (F&O) | 44933 | 1396.89 | 1351.24 | 1433.80 | 1394.65 | 1411.00 | -1.17 |

| DIVISLAB (F&O) | 37956 | 5256.25 | 5168.60 | 5326.34 | 5248.90 | 5315.50 | -1.27 |

| BEPL | 72471 | 210.25 | 192.61 | 224.89 | 210.20 | 213.60 | -1.62 |

| TAJGVK | 25314 | 150.06 | 135.21 | 162.48 | 149.80 | 153.00 | -2.14 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| HDFCAMC (F&O) | 15653 | 2889.06 | 2955.16 | 2836.98 | 2900.40 | 2875.65 | 0.85 |

| DEVYANI | 28595 | 112.89 | 126.50 | 102.57 | 114.05 | 112.10 | 1.71 |

| CAMS | 35112 | 3080.25 | 3148.44 | 3026.51 | 3081.85 | 3020.00 | 2.01 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HDFCAMC (F&O) | 1.66% |

| NTPC (F&O) | 2.05% |

| AUROPHARMA (F&O) | 3.20% |

| WELCORP | 3.26% |

| GRINFRA | 3.45% |

| KPITTECH | 3.71% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| SEQUENT | 0.02% |

| COCHINSHIP | 0.05% |

| GODREJAGRO | 0.42% |

| REPCOHOME | 0.78% |

| MAHINDCIE | 0.89% |

| PNCINFRA | 0.92% |

| CSBBANK | 1.04% |

| HAL (F&O) | 1.17% |

| HDFCAMC (F&O) | 1.25% |

| ALKEM (F&O) | 1.25% |

| DIVISLAB (F&O) | 1.27% |

| LALPATHLAB (F&O) | 1.31% |

| BEPL | 1.62% |

| DEVYANI | 1.62% |

| RITES | 1.71% |

| BHARTIARTL (F&O) | 1.96% |

| WATERBASE | 2.02% |

| GUJGASLTD (F&O) | 2.13% |

| IRB | 2.13% |

| TAJGVK | 2.14% |

| RBLBANK (F&O) | 2.20% |

| BALRAMCHIN | 2.40% |

| NAVINFLUOR (F&O) | 2.96% |

| HINDCOPPER | 2.98% |

| ITI | 3.25% |

| JINDALSAW | 3.45% |

| GRAPHITE | 3.61% |

| CHALET | 3.68% |

| MONTECARLO | 3.69% |

| APEX | 3.99% |

| CAMS | 4.13% |

| ASTRAL (F&O) | 4.16% |

| DALBHARAT | 4.20% |

| LTTS (F&O) | 4.37% |

| NAVNETEDUL | 4.45% |

| CANFINHOME (F&O) | 4.45% |

| FORTIS | 4.56% |

| VIJAYA | 4.57% |

| APTUS | 4.62% |

| SPARC | 4.86% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

DEVYANI Buy @ 115.55 or above

ACC (F&O) Buy @ 2268.15 or above

UBL (F&O) Sell @ 1722.25 or Below

HEROMOTOCO (F&O) Sell @ 29160 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AFFLE

COFORGE (F&O)

LTTS (F&O)

MPHASIS (F&O)

NATCOPHARM

SURYAROSNI

TORNTPOWER (F&O)

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ACC (F&O)

BRITANNIA (F&O)

FINPIPE

GNA

HINDOILEXP

IRCTC (F&O)

KEI

NESCO

RAIN

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BLISSGVS

SELAN

SHK

Higher Level Consolidation

PCALAB

PIDILITIND (F&O)

Lower Level Consolidation

BERGEPAINT (F&O)

DEVYANI

REDINGTON

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ASHOKLEY (F&O)

BEPL

BORORENEW

DBL

MOTHERSUMI (F&O)

SONACOMS

TATACHEM (F&O)

TATAMOTORS (F&O)

TATAMTRDVR

TATAPOWER (F&O)

GAP DOWN BREAKOUT STOCKS

SRF (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

ACE

KANSAINER

POONAWALLA

RKFORGE

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

BORORENEW

GDL

BEARISH MARUBOZU PATTERN

BCG

TIMESGTY

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ARVIND

KOPRAN

BEARISH BELLHOLD PATTERN

APLAPOLLO

BLS

GENESYS

INDIGO (F&O)

INDORAMA

KIOCL

RKFORGE

SRF (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

APOLLOTYRE (F&O)

BALMLAWRIE

BERGEPAINT (F&O)

COROMANDEL (F&O)

GLENMARK (F&O)

HDFC (F&O)

KOTAKBANK (F&O)

KTKBANK

RALLIS

SELL RECOMMENDATION IF THE MARKET IS BEARISH

GRANULES (F&O)

PETRONET (F&O)

SADBHAV

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

GLS

FCL

DODLA

ICICIGI (F&O)

HDFCLIFE (F&O)

LINDEINDIA

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

UBL (F&O)

PHOENIXLTD

JAICORPLTD

ADANIENT (F&O)

TATAELXSI

RAYMOND

HGINFRA

BRIGADE

INDIACEM

CCL

KRBL

BANDHANBNK (F&O)

GODREJPROP (F&O)

HDFCBANK (F&O)

MOTILALOFS

RELIANCE (F&O)

DEEPAKNTR (F&O)

MANAPPURAM (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

FDC

IPL

JTEKTINDIA

KOLTEPATIL

SVPGLOB

TATACOMM

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

ARIHANTSUP

POWERMECH

XPROINDIA

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| PIIND (F&O) | 3337.40 | 3349.52 | 3335.06 | 3362.32 | 3376.83 | 3391.37 | 3405.94 |

| HCLTECH (F&O) | 1265.35 | 1269.14 | 1260.25 | 1277.42 | 1286.37 | 1295.35 | 1304.36 |

| IPCALAB | 2362.95 | 2364.39 | 2352.25 | 2375.37 | 2387.57 | 2399.80 | 2412.06 |

| RELAXO | 1366.15 | 1369.00 | 1359.77 | 1377.58 | 1386.87 | 1396.19 | 1405.55 |

| ERIS | 797.50 | 798.06 | 791.02 | 804.74 | 811.84 | 818.98 | 826.15 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| DHANI | 196.00 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| LICHSGFIN (F&O) | 446.65 | 446.27 | 451.56 | 441.22 | 435.98 | 430.78 | 425.60 |

| FINPIPE | 231.35 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| GREENPLY | 185.85 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| PRECAM | 108.65 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| NATIONALUM (F&O) | 51088573 | 105.25 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| ITC (F&O) | 50159625 | 249.20 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

| ZEEL (F&O) | 45042091 | 317.00 | 319.52 | 315.06 | 323.84 | 328.35 | 332.90 | 337.47 |

| POWERGRID (F&O) | 24806711 | 199.40 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| MOTHERSUMI (F&O) | 22710117 | 253.70 | 256.00 | 252.02 | 259.89 | 263.93 | 268.01 | 272.11 |

| VEDL (F&O) | 16291520 | 319.45 | 319.52 | 315.06 | 323.84 | 328.35 | 332.90 | 337.47 |

| INDIANB | 14750933 | 163.55 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| JINDALSTEL (F&O) | 14252173 | 432.60 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| ADANIPOWER | 10940656 | 106.70 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| TATACOFFEE | 10637119 | 233.90 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| WIPRO (F&O) | 9462941 | 672.60 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

| ADANIPORTS (F&O) | 9083125 | 759.00 | 763.14 | 756.25 | 769.68 | 776.63 | 783.61 | 790.62 |

| BEPL | 7932106 | 210.20 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| TATACONSUM (F&O) | 7233280 | 848.15 | 848.27 | 841.00 | 855.13 | 862.46 | 869.81 | 877.20 |

| GSFC | 6027281 | 139.55 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| PTC | 5814413 | 137.15 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| TINPLATE | 3762370 | 334.90 | 337.64 | 333.06 | 342.08 | 346.72 | 351.39 | 356.09 |

| INOXWIND | 3747421 | 127.65 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| DBL | 3277441 | 725.40 | 729.00 | 722.27 | 735.40 | 742.19 | 749.02 | 755.87 |

| IRCTC (F&O) | 3242132 | 4928.80 | 4935.06 | 4917.52 | 4950.16 | 4967.76 | 4985.40 | 5003.06 |

| HINDZINC | 3029449 | 332.85 | 333.06 | 328.52 | 337.47 | 342.08 | 346.72 | 351.39 |

| CHOLAFIN (F&O) | 2968636 | 594.50 | 600.25 | 594.14 | 606.09 | 612.26 | 618.46 | 624.69 |

| JSL | 2957377 | 172.05 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| RALLIS | 2829919 | 314.75 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| WELCORP | 2800373 | 147.20 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ONGC (F&O) | 16690451 | 160.00 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| ASHOKA | 4745240 | 118.10 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| FILATEX | 2686372 | 115.55 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| WELSPUNIND | 1655330 | 161.60 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| LXCHEM | 1493051 | 548.00 | 546.39 | 552.25 | 540.83 | 535.03 | 529.26 | 523.53 |

| RADICO | 1178176 | 1127.40 | 1122.25 | 1130.64 | 1114.45 | 1106.12 | 1097.81 | 1089.54 |

| PRESTIGE | 1097344 | 458.30 | 456.89 | 462.25 | 451.79 | 446.49 | 441.22 | 435.98 |

| MARUTI (F&O) | 1084436 | 7482.15 | 7460.64 | 7482.25 | 7442.78 | 7421.22 | 7399.70 | 7378.20 |

| OIL | 1075013 | 229.70 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| BODALCHEM | 1029848 | 142.60 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| KANSAINER | 804090 | 598.40 | 594.14 | 600.25 | 588.36 | 582.31 | 576.29 | 570.30 |

| BSE | 771216 | 1421.40 | 1415.64 | 1425.06 | 1406.95 | 1397.59 | 1388.26 | 1378.95 |

| DCAL | 759755 | 237.35 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| ACE | 722580 | 258.15 | 256.00 | 260.02 | 252.14 | 248.19 | 244.26 | 240.37 |

| JUSTDIAL | 624427 | 928.90 | 922.64 | 930.25 | 915.52 | 907.97 | 900.45 | 892.96 |

| XCHANGING | 619336 | 118.95 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| ONMOBILE | 616578 | 119.15 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| EPL | 603445 | 233.70 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| HIKAL | 587288 | 494.40 | 489.52 | 495.06 | 484.24 | 478.75 | 473.30 | 467.87 |

| GMBREW | 542172 | 855.85 | 855.56 | 862.89 | 848.69 | 841.42 | 834.18 | 826.98 |

| TRIGYN | 447446 | 133.05 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| GESHIP | 441185 | 362.45 | 361.00 | 365.77 | 356.44 | 351.74 | 347.06 | 342.42 |

| ASALCBR | 428961 | 610.95 | 606.39 | 612.56 | 600.55 | 594.44 | 588.36 | 582.31 |

| CHALET | 396326 | 242.95 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| NBVENTURES | 388228 | 122.95 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |