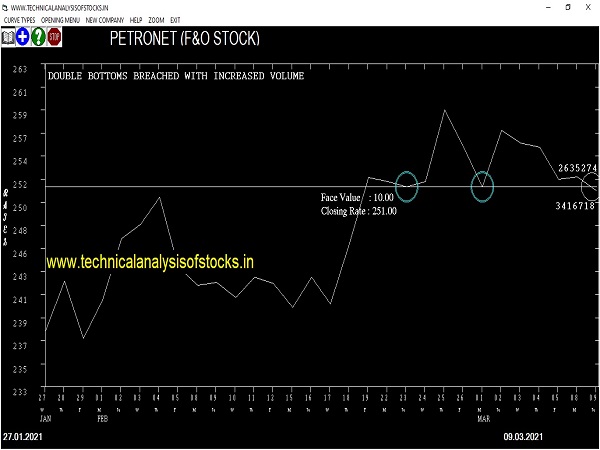

SELL PETRONET (NSE Symbol) Sell @ 248.06 or Below after cooling period. SIGNAL : DOUBLE BOTTOMS BREACHED WITH INCREASED VOLUME. Stop Loss : 268 Target : 232.70 (Short term)

HOT BUZZING STOCKS (10.03.2021)

NSE SYMBOL CLOSING RATE

AURIONPRO 100.55

CAPTRUST 119.75

HNDFDS 2411.90

OLECTRA 205.85

OPTIEMUS 178.90

NDTV 55.90

SHEMAROO 73.35

YAARII 152.20

IRISDOREME 99.75

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| VBL | 20675 | 1008.10 | 993.20 | 1.50 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| ONGC (F&O) | 113160 | 118.27 | 105.12 | 129.33 | 116.75 | 118.40 | -1.41 |

| GMMPFAUDLR | 37405 | 4372.52 | 4292.40 | 4436.67 | 4361.05 | 4426.70 | -1.51 |

| AXISBANK (F&O) | 276230 | 749.39 | 715.92 | 776.63 | 745.45 | 758.70 | -1.78 |

| DEEPAKFERT | 21258 | 210.25 | 192.61 | 224.89 | 207.00 | 212.00 | -2.42 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| M&M (F&O) | 62103 | 848.27 | 884.62 | 819.80 | 852.00 | 847.05 | 0.58 |

| GUJGASLTD (F&O) | 24153 | 534.77 | 563.78 | 512.15 | 538.40 | 525.30 | 2.43 |

| MARICO (F&O) | 24472 | 400.00 | 425.18 | 380.44 | 401.30 | 390.70 | 2.64 |

| HDFCBANK (F&O) | 190281 | 1560.25 | 1609.21 | 1521.76 | 1562.50 | 1521.00 | 2.66 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (Trading opportunity from 10 Mar 21)

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

MARICO,2.85%

CIPLA,2.89%

SUVENPHAR,3.26%

DEEPAKFERT,5.92%

HEIDELBERG,6.10%

VRLLOG,8.10%

DALBHARAT,8.44%

NIACL,12.78%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (Trading opportunity from 10 Mar 21)

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

ONGC,1.41%

GMMPFAUDLR,1.51%

HDFCBANK,1.69%

AXISBANK,1.78%

M&M,1.88%

DEEPAKFERT,2.42%

CHOLAFIN,2.50%

DCBBANK,3.34%

NTPC,3.84%

COALINDIA,3.96%

GODREJCP,4.22%

ADVENZYMES,4.31%

M&MFIN,4.48%

JSWSTEEL,4.91%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NAM-INDIA (F&O) Sell @ 346 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

CHAMBLFERT Sell @ 233 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

BPCL (F&O) Sell @ 441 0 or Below

GREAVESCOT Sell @150.06 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

DBL

GLAND

LTI (F&O)

OLECTRA

SHALBY

ULTRACEMCO (F&O)

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

CANTABIL

GLOBUSSPR

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BLISSGVS

CHEMCON

EICHERMOT (F&O)

PIIND (F&O)

POLYCAB

RELAXO

Higher Level Consolidation

DIVISLAB (F&O)

EICHERMOT (F&O)

HINDUNILVR (F&O)

KELLTONTEC

SUVENPHAR

TORNTPHARM (F&O)

Lower Level Consolidation

AVANTIFEED

CADILAHC (F&O)

CANTABIL

HINDUNILVR (F&O)

JKTYRE

KALPATPOWR

KITEX

MINDTREE (F&O)

RELAXO

TCS (F&O)

TECHM (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ADVANIHOTR

BHARATGEAR

GEOJITFSL

MFSL (F&O)

PALASHSECU

SBILIFE (F&O)

VENUSREM

VISHAL

GAP DOWN BREAKOUT STOCKS

BPCL (F&O)

Strategy :ENGULFING STOCKS

BULLISH ENGULFING

BIOFILCHEM

BEARISH ENGULFING

BIOCON (F&O)

MOLDTKPAC

VETO

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NDTV

OPTIEMUS

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

VINYLINDIA

YAARII

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

JSWENERGY

SCHAND

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ACC (F&O)

BANCOINDIA

BANKBARODA (F&O)

BDL

BEL (F&O)

DELTACORP

DMART

FORTIS

GATI

GEOJITFSL

GRSE

HIMATSEIDE

HINDPETRO (F&O)

JAGSNPHARM

JAYSREETEA

JINDALSTEL (F&O)

JMFINANCIL

JUBLFOOD (F&O)

LTTS (F&O)

M&M (F&O)

MAHLOG

MOIL

NMDC (F&O)

PITTIENG

RECLTD (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ASIANPAINT (F&O)

BALKRISIND (F&O)

BATAINDIA (F&O)

CIPLA (F&O)

ISEC

MARICO (F&O)

PARAGMILK

RALLIS

SUMICHEM

SUNTECK

UJJIVAN

VAKRANGEE

ZENTEC

ZYDUSWELL

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| NESTLEIND (F&O) | 16910.80 | 16932.52 | 16900.00 | 16956.58 | 16989.14 | 17021.73 | 17054.36 |

| POLYCAB | 1360.15 | 1369.00 | 1359.77 | 1377.58 | 1386.87 | 1396.19 | 1405.55 |

| LTTS (F&O) | 2740.30 | 2743.14 | 2730.06 | 2754.87 | 2768.01 | 2781.17 | 2794.37 |

| BAJAJCON | 265.10 | 268.14 | 264.06 | 272.11 | 276.25 | 280.42 | 284.62 |

| COROMANDEL | 776.80 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| AWHCL | 296.10 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| SUMICHEM | 292.70 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| APCOTEXIND | 176.60 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| GODREJIND | 478.25 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |

| ORIENTELEC | 283.20 | 280.56 | 284.77 | 276.53 | 272.39 | 268.27 | 264.19 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ICICIBANK (F&O) | 23056249 | 625.10 | 631.27 | 625.00 | 637.24 | 643.57 | 649.92 | 656.31 |

| BALMLAWRIE | 15159761 | 154.15 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| M&MFIN (F&O) | 13182305 | 208.65 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| ABCAPITAL | 9577378 | 134.30 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| PRAJIND | 8785097 | 187.70 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| KOTAKBANK (F&O) | 7918345 | 1978.95 | 1980.25 | 1969.14 | 1990.39 | 2001.56 | 2012.76 | 2023.99 |

| HDFCBANK (F&O) | 7533348 | 1562.50 | 1570.14 | 1560.25 | 1579.27 | 1589.22 | 1599.20 | 1609.21 |

| FORTIS | 6748783 | 181.70 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| HDFCLIFE (F&O) | 5412952 | 740.20 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

| JUSTDIAL | 3466723 | 983.35 | 984.39 | 976.56 | 991.75 | 999.64 | 1007.56 | 1015.51 |

| HDFC (F&O) | 2877662 | 2577.30 | 2588.27 | 2575.56 | 2599.70 | 2612.46 | 2625.25 | 2638.07 |

| TECHM (F&O) | 2814747 | 988.15 | 992.25 | 984.39 | 999.64 | 1007.56 | 1015.51 | 1023.49 |

| ELGIEQUIP | 2205294 | 204.50 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| TRENT (F&O) | 1947228 | 905.75 | 907.52 | 900.00 | 914.60 | 922.18 | 929.78 | 937.42 |

| MAGMA | 1716961 | 129.05 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| MAYURUNIQ | 1426593 | 433.65 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| RAMCOIND | 1319993 | 267.85 | 268.14 | 264.06 | 272.11 | 276.25 | 280.42 | 284.62 |

| INDOCO | 820891 | 287.55 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| MINDACORP | 749337 | 101.60 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| MINDTREE (F&O) | 732082 | 1796.35 | 1806.25 | 1795.64 | 1815.98 | 1826.65 | 1837.35 | 1848.08 |

| ZODIACLOTH | 728867 | 113.30 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| ITDC | 662853 | 375.10 | 375.39 | 370.56 | 380.06 | 384.95 | 389.87 | 394.82 |

| TIINDIA | 517974 | 1173.00 | 1173.06 | 1164.52 | 1181.05 | 1189.65 | 1198.29 | 1206.96 |

| VERTOZ | 428564 | 303.65 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| POLYMED | 426573 | 756.90 | 763.14 | 756.25 | 769.68 | 776.63 | 783.61 | 790.62 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| BPCL (F&O) | 199790953 | 445.90 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

| IOC (F&O) | 29925269 | 100.55 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| GAIL (F&O) | 20477362 | 149.05 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| TATASTEEL (F&O) | 19556438 | 706.75 | 702.25 | 708.89 | 695.99 | 689.41 | 682.86 | 676.34 |

| L&TFH (F&O) | 16996487 | 105.55 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| MOTHERSUMI (F&O) | 16995632 | 216.45 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| NMDC (F&O) | 14633341 | 131.55 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| HINDPETRO (F&O) | 12765130 | 238.20 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| BEL (F&O) | 12371248 | 140.00 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| SCI | 8184288 | 126.15 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| JINDALSTEL (F&O) | 8121292 | 312.85 | 310.64 | 315.06 | 306.40 | 302.04 | 297.71 | 293.41 |

| HINDCOPPER | 5415376 | 137.80 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| IRB | 5274226 | 121.00 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| CONCOR (F&O) | 3375768 | 583.85 | 582.02 | 588.06 | 576.29 | 570.30 | 564.34 | 558.42 |

| FSL | 2854889 | 102.55 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| DELTACORP | 2455227 | 166.05 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| AUBANK (F&O) | 2398975 | 1232.55 | 1225.00 | 1233.77 | 1216.87 | 1208.17 | 1199.49 | 1190.85 |

| INDHOTEL | 2205348 | 123.85 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| SUNTV (F&O) | 2180349 | 491.05 | 489.52 | 495.06 | 484.24 | 478.75 | 473.30 | 467.87 |

| BURGERKING | 1945043 | 139.95 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| HINDOILEXP | 1871187 | 105.50 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| CHENNPETRO | 1858429 | 116.55 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| GATI | 1665271 | 106.60 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| INDIANB | 1639639 | 135.15 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| DCAL | 1616623 | 130.40 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |