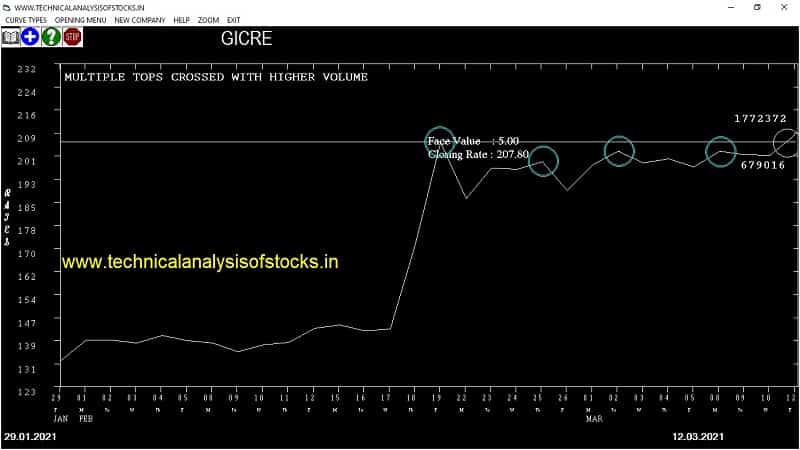

BUY GICRE (NSE Symbol) Buy @ 210.25 or Above after cooling period. SIGNAL : MULTIPLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 192.60 Target : 224.90 (Short term)

HOT BUZZING STOCKS (15.03.2021)

NSE SYMBOL CLOSING RATE

CLEDUCATE 84.15

APOLLOPIPE 885.25

AURIONPRO 132.70

JINDALPOLY 858.00

HOVS 47.00

IDBI 42.00

VAIBHAVGBL 4157.35

ONMOBILE 107.25

GREENPANEL 179.30

PRECOT 105.50

BAFNAPH 139.55

INDSWFTLAB 82.45

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| STLTECH | 19232 | 219.90 | 220.30 | 0.18 |

| TATACHEM (F&O) | 144179 | 782.00 | 783.85 | 0.24 |

| INTELLECT | 30586 | 492.00 | 498.05 | 1.21 |

| MAHLOG | 35445 | 552.30 | 566.20 | 2.45 |

| IEX | 263949 | 318.80 | 328.25 | 2.88 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| VBL | 31032 | 976.60 | 976.15 | 0.05 |

| DRREDDY (F&O) | 56974 | 4444.00 | 4426.50 | 0.40 |

| ASHOKA | 12179 | 110.25 | 109.40 | 0.78 |

| MFSL (F&O) | 23806 | 901.10 | 892.80 | 0.93 |

| VIPIND | 28102 | 396.80 | 392.85 | 1.01 |

| CASTROLIND | 18653 | 133.05 | 129.85 | 2.46 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| JBCHEPHARM | 11155 | 1225.00 | 1182.23 | 1259.62 | 1220.20 | 1224.00 | -0.31 |

| DEEPAKFERT | 40936 | 221.27 | 203.16 | 236.27 | 218.30 | 219.25 | -0.44 |

| HEG | 79284 | 1640.25 | 1590.81 | 1680.16 | 1634.25 | 1644.00 | -0.60 |

| IPCALAB | 21779 | 1958.06 | 1904.09 | 2001.56 | 1952.65 | 1972.75 | -1.03 |

| AMBUJACEM (F&O) | 41642 | 293.27 | 272.39 | 310.49 | 289.50 | 294.30 | -1.66 |

| CIPLA (F&O) | 53575 | 812.25 | 777.40 | 840.58 | 805.95 | 820.00 | -1.74 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| MARICO (F&O) | 33918 | 390.06 | 414.93 | 370.75 | 393.90 | 390.70 | 0.81 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (Trading opportunity from 15 MAR 21)

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

IPCALAB,1.03%

CIPLA,1.74%

AIAENG,2.06%

POLYCAB,2.09%

TORNTPOWER,4.23%

MARICO,4.79%

SUVENPHAR,5.09%

ADANIENT,5.68%

PVR,5.89%

DALBHARAT,6.74%

GLAND,8.90%

DBL,10.14%

GSPL,12.05%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (Trading opportunity from 15 MAR 21)

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

DEEPAKFERT,0.44%

HEG,0.60%

TATAPOWER,0.66%

AMBUJACEM,1.66%

UFLEX,1.86%

CESC,2.25%

JBCHEPHARM,2.28%

KALPATPOWR,2.43%

CADILAHC,2.49%

CHOLAHLDNG,2.69%

ONGC,2.91%

ENDURANCE,3.00%

DCBBANK,3.07%

GODREJCP,3.26%

RAMCOCEM,3.28%

ITI,3.29%

DRREDDY,3.54%

RELIANCE,3.85%

NATCOPHARM,3.87%

HDFCBANK,3.99%

ERIS,4.03%

EIHOTEL,4.03%

NTPC,4.22%

FINCABLES,4.26%

ACC,4.27%

M&MFIN,4.36%

RBLBANK,4.55%

GRSE,4.62%

NIACL,4.70%

COALINDIA,4.78%

PHOENIXLTD,4.83%

SONATSOFTW,4.83%

CHOLAFIN,4.93%

GESHIP,4.95%

INOXLEISUR,4.97%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

TAJGVK Sell @ 122 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

HEIDELBERG Buy @ 228.75 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AUBANK (F&O)

BEML

BIGBLOC

GPIL

GSPL

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

GSPL

RAILTEL

SYMPHONY

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

ALEMBICLTD

BSE

CGPOWER

FINCABLES

IDFCFIRSTB (F&O)

JYOTHYLAB

PSPPROJECT

Higher Level Consolidation

ASTERDM

BRITANNIA (F&O)

CADILAHC (F&O)

COLPAL (F&O)

DIVISLAB (F&O)

GDL

KNRCON

SBIN (F&O)

Lower Level Consolidation

ALEMBICLTD

CADILAHC (F&O)

CHAMBLFERT

DABUR (F&O)

EPL

FINCABLES

FLFL

JYOTHYLAB

KSCL

MCX

UTIAMC

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

APOLLOHOSP (F&O)

ATGL

BORORENEW

DELTACORP

GICRE

GREENPANEL

JINDALPOLY

KABRAEXTRU

NIACL

ONMOBILE

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

ADANIGREEN

ALLCARGO

AUROPHARMA

BRITANNIA

DLF

DOLAT

DRREDDY

EIHOTEL

HDFC

HDFCBANK

ICICIBANK

INDIAGLYCO

JINDALSAW

JSL

MFSL

MIRZAINT

PURVA

SUNPHARMA

SUNTV

TIRUMALCHM

TRITURBINE

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

JINDALPOLY

BEARISH BELLHOLD PATTERN

HDFCLIFE (F&O)

ICICITECH

OPTIEMUS

Strategy : GARTLEY SIGNAL (W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

SWSOLAR

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

AJANTPHARM

APOLLOTYRE (F&O)

BDL

BEL (F&O)

CAMS

CYIENT

DMART

ESCORTS (F&O)

GAIL (F&O)

GATI

GRSE

IRB

JAICORPLTD

JUBLFOOD (F&O)

LINCOLN

LTTS (F&O)

NAM-INDIA (F&O)

NRBBEARING

ONWARDTEC

PHILIPCARB

PITTIENG

PRAKASH

RELIANCE (F&O)

SHREDIGCEM

SRTRANSFIN (F&O)

TVSMOTOR (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ASIANPAINT (F&O)

BATAINDIA (F&O)

BOROLTD

INDOCO

ISEC

JINDWORLD

KSCL

NH

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| HERITGFOOD | 340.25 | 342.25 | 337.64 | 346.72 | 351.39 | 356.09 | 360.82 |

| EMAMILTD | 487.35 | 489.52 | 484.00 | 494.81 | 500.39 | 506.00 | 511.63 |

| ALKEM (F&O) | 2773.50 | 2782.56 | 2769.39 | 2794.37 | 2807.60 | 2820.85 | 2834.14 |

| SUNDRMFAST | 745.85 | 749.39 | 742.56 | 755.87 | 762.76 | 769.68 | 776.63 |

| KSCL | 513.55 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| NIITLTD | 187.75 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| DALBHARAT | 1474.60 | 1472.64 | 1482.25 | 1463.79 | 1454.24 | 1444.72 | 1435.23 |

| RADICO | 572.25 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| CUMMINSIND (F&O) | 883.90 | 877.64 | 885.06 | 870.69 | 863.32 | 855.99 | 848.69 |

| GESHIP | 319.20 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| IOC (F&O) | 34987666 | 101.30 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| BPCL (F&O) | 26396386 | 457.55 | 462.25 | 456.89 | 467.41 | 472.83 | 478.28 | 483.76 |

| PFC (F&O) | 25608930 | 137.70 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| POWERGRID (F&O) | 10222359 | 220.05 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| TATACHEM (F&O) | 8922262 | 783.85 | 784.00 | 777.02 | 790.62 | 797.66 | 804.74 | 811.84 |

| NIACL | 4720004 | 164.75 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| MAXHEALTH | 4453797 | 206.25 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| GREENPANEL | 4085530 | 179.30 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| TATACOFFEE | 4053075 | 131.70 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| OLECTRA | 3385686 | 226.80 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| DEEPAKFERT | 2794601 | 218.30 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| ATGL | 2474722 | 738.00 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

| GICRE | 1772372 | 207.80 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| GSPL | 1745805 | 277.95 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| ONMOBILE | 1606409 | 107.25 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| BORORENEW | 1530339 | 284.00 | 284.77 | 280.56 | 288.86 | 293.12 | 297.41 | 301.74 |

| APOLLOHOSP (F&O) | 1512021 | 2976.35 | 2983.89 | 2970.25 | 2996.06 | 3009.76 | 3023.49 | 3037.25 |

| AARTIDRUGS | 1427665 | 688.30 | 689.06 | 682.52 | 695.29 | 701.90 | 708.54 | 715.20 |

| ROUTE | 1299100 | 1642.60 | 1650.39 | 1640.25 | 1659.73 | 1669.93 | 1680.16 | 1690.42 |

| MGL (F&O) | 1239058 | 1208.10 | 1216.27 | 1207.56 | 1224.39 | 1233.15 | 1241.94 | 1250.76 |

| CYIENT | 1106751 | 679.60 | 682.52 | 676.00 | 688.72 | 695.29 | 701.90 | 708.54 |

| MAHINDCIE | 1059504 | 175.05 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| ORIENTELEC | 1052330 | 295.15 | 297.56 | 293.27 | 301.74 | 306.10 | 310.49 | 314.90 |

| INTELLECT | 966441 | 498.05 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| IIFL | 902455 | 313.15 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| SBILIFE (F&O) | 28967831 | 914.20 | 907.52 | 915.06 | 900.45 | 892.96 | 885.51 | 878.08 |

| ICICIBANK (F&O) | 21757862 | 612.85 | 612.56 | 618.77 | 606.69 | 600.55 | 594.44 | 588.36 |

| VEDL (F&O) | 21345125 | 221.40 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| CANBK (F&O) | 15901414 | 157.00 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| HINDALCO (F&O) | 15035151 | 330.20 | 328.52 | 333.06 | 324.16 | 319.68 | 315.22 | 310.80 |

| IBULHSGFIN (F&O) | 12893118 | 224.05 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| MOTHERSUMI (F&O) | 12325376 | 213.60 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| ADANIPORTS (F&O) | 10961076 | 728.15 | 722.27 | 729.00 | 715.92 | 709.25 | 702.60 | 695.99 |

| RELIANCE (F&O) | 7783173 | 2137.60 | 2127.52 | 2139.06 | 2117.06 | 2105.57 | 2094.11 | 2082.68 |

| ICICIPRULI (F&O) | 6200011 | 461.80 | 456.89 | 462.25 | 451.79 | 446.49 | 441.22 | 435.98 |

| RAIN | 3909022 | 148.10 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| SCI | 3729892 | 121.20 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| RAILTEL | 3649504 | 145.05 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| HDFCLIFE (F&O) | 3271450 | 710.80 | 708.89 | 715.56 | 702.60 | 695.99 | 689.41 | 682.86 |

| QUICKHEAL | 3129219 | 199.25 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| ABCAPITAL | 2937746 | 131.30 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| BAJAJCON | 2588836 | 269.95 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| CASTROLIND | 2216554 | 129.85 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| TVSMOTOR (F&O) | 1975870 | 584.20 | 582.02 | 588.06 | 576.29 | 570.30 | 564.34 | 558.42 |

| INDIANB | 1672189 | 131.50 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| GATI | 1473526 | 106.10 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| GREAVESCOT | 1420785 | 143.90 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| GABRIEL | 1417759 | 115.90 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| GUJGASLTD (F&O) | 1366818 | 518.50 | 517.56 | 523.27 | 512.15 | 506.50 | 500.89 | 495.31 |

| MUTHOOTFIN (F&O) | 1322927 | 1278.25 | 1278.06 | 1287.02 | 1269.78 | 1260.88 | 1252.02 | 1243.18 |