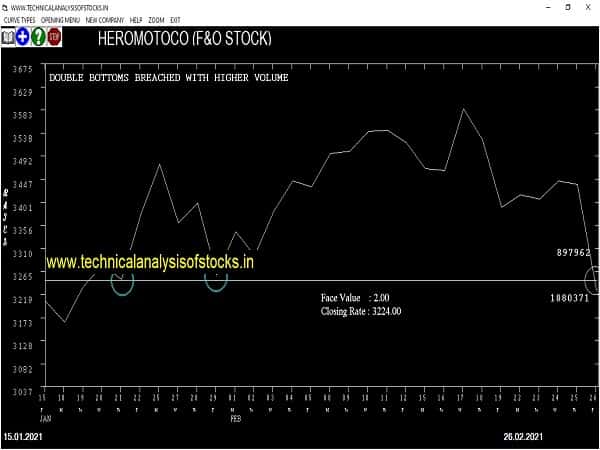

SELL HEROMOTOCO (NSE Symbol) Sell @ 3220.55 or Below after cooling period. SIGNAL : DOUBLE BOTTOMS BREACHED WITH HIGHER VOLUME. Stop Loss : 3275 Target : 3165.65 (Short term)

HOT BUZZING STOCKS (01.03.2021)

NSE SYMBOL CLOSING RATE

EVEREADY 311.75

IRISDOREME 123.25

TVSELECT 174.40

BIOFILCHEM 86.15

RAMKY 78.80

BHAGYANGR 46.40

OPTIEMUS 171.65

GANESHHOUC 56.05

ONMOBILE 109.10

HNDFDS 2153.95

Strategy : TODAY’S PENNANT BREAKOUTS

| BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS) | ||||

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| NIL | ||||

| BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS) | ||||

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| HINDZINC | 36266 | 298.35 | 297.50 | 0.29 |

| INDIANB | 23639 | 136.55 | 136.05 | 0.37 |

| HINDUNILVR (F&O) | 155473 | 2150.00 | 2132.05 | 0.84 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

| 1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS) | |||||||||||||

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF | % GREATER | |||||

| SBICARD | 68942 | 1072.56 | 1032.53 | 1105.01 | 1068.60 | 1095.25 | -2.49 | 1.96 | |||||

| 1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS) | |||||||||||||

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF | % LESSAER | |||||

| BHARATFORG (F&O) | 70300 | 606.39 | 637.24 | 582.31 | 610.05 | 595.05 | 2.46 | -0.48 | |||||

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (Trading opportunity from 01 MAR 21)

(In the increasing order of closeness to the top of the first tallest candlestick from the current date)

ATGL,1.50%

ORIENTELEC,3.42%

TATACOMM,3.44%

GLAND,3.76%

PNCINFRA,6.63%

SOLARINDS,8.09%

MAANALU,8.36%

ITI,8.83%

NILKAMAL,9.53%

IEX,10.11%

KRBL,12.24%

KNRCON,12.73%

NEOGEN,13.55%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (Trading opportunity from 01 MAR 21)

(In the increasing order of closeness to the top of the first tallest candlestick from the current date)

MANGLMCEM,1.37%

GREENPLY,1.86%

COROMANDEL,2.16%

GUJGASLTD,2.28%

SBICARD,2.49%

HINDUNILVR,2.91%

KSCL,2.94%

JUBLPHARMA,3.17%

BHARATFORG,3.41%

UFLEX,3.43%

BALAMINES,3.45%

RAJESHEXPO,3.63%

ONGC,4.05%

HINDPETRO,4.10%

FORTIS,4.20%

PHILIPCARB,4.34%

BEPL,4.36%

JKLAKSHMI,4.39%

LAOPALA,4.45%

INTELLECT,4.60%

CENTURYTEX,4.85%

HINDZINC,4.87%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

OLECTRA Sell @ 178.90 or Below

APARINDS Sell @ 456.90 or Below

TATAELXSI Sell @ 2652.25 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

HGINFRA

JKTYRE

MFSL (F&O)

REDINGTON

SESHAPAPER

SHILPAMED

SMSPHARMA

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ADVENZYMES

CAPLIPOINT

HERCULES

KAMDHENU

NATCOPHARM

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

EIHOTEL

GRSE

JINDWORLD

Higher Level Consolidation

CESC

EIDPARRY

GHCL

MCX

NATCOPHARM

OBEROIRLTY

ORIENTELEC

SHK

Lower Level Consolidation

NESTLEIND (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ACRYSIL

RCF

TOTAL

TVSELECT

GAP DOWN BREAKOUT STOCKS

APOLLOTYRE (F&O)

AXISBANK (F&O)

BAJAJFINSV (F&O)

BAJFINANCE (F&O)

BSOFT

CANBK (F&O)

CUB

DLF (F&O)

HDFC (F&O)

HDFCBANK (F&O)

ICICIBANK (F&O)

ICICIPRULI (F&O)

INDIANB

ITC (F&O)

KOTAKBANK (F&O)

LICHSGFIN (F&O)

LT (F&O)

MAZDOCK

MFSL (F&O)

MSTCLTD

ONMOBILE

RBLBANK (F&O)

SBIN (F&O)

SRTRANSFIN (F&O)

TECHM (F&O)

WIPRO (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

ATGL

BLS

DAAWAT

DBCORP

DREDGECORP

DYNAMATECH

GREENPLY

INDHOTEL

INDIGOPNTS

JAMNAAUTO

MANALIPETC

MASFIN

PRABHAT

SAIL (F&O)

BEARISH ENGULFING

TEXINFRA

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

EVEREADY

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

TVSELECT

BEARISH BELLHOLD PATTERN

KOTAKBANK (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

AMBUJACEM (F&O)

BANCOINDIA

GODREJPROP (F&O)

GSFC

IRCON

JUBLFOOD (F&O)

MANAPPURAM (F&O)

MGL (F&O)

MUTHOOTFIN (F&O)

ORIENTCEM

PFC (F&O)

POLYCAB

TVSMOTOR (F&O)

UTIAMC

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ALLCARGO

BALAJITELE

BSE

CESC

DIVISLAB (F&O)

EICHERMOT (F&O)

GEOJITFSL

GLENMARK (F&O)

HCLTECH (F&O)

LTI

PARAGMILK

SHK

SUMICHEM

SYNGENE

TCS (F&O)

TITAN (F&O)

UJJIVAN (F&O)

ZENTE

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| KAJARIACER | 947.05 | 953.27 | 945.56 | 960.52 | 968.28 | 976.07 | 983.90 |

| GODREJIND | 446.45 | 451.56 | 446.27 | 456.66 | 462.02 | 467.41 | 472.83 |

| HGINFRA | 285.00 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| AARTIIND | 1235.00 | 1242.56 | 1233.77 | 1250.76 | 1259.62 | 1268.51 | 1277.42 |

| JYOTHYLAB | 148.85 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ERIS | 586.40 | 582.02 | 588.06 | 576.29 | 570.30 | 564.34 | 558.42 |

| GRAPHITE | 481.20 | 478.52 | 484.00 | 473.30 | 467.87 | 462.48 | 457.12 |

| BALAMINES | 1629.15 | 1620.06 | 1630.14 | 1610.82 | 1600.80 | 1590.81 | 1580.85 |

| SUNTECK | 347.75 | 346.89 | 351.56 | 342.42 | 337.81 | 333.23 | 328.68 |

| MIDHANI | 191.20 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ABCAPITAL | 13262514 | 123.65 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| GREAVESCOT | 7330000 | 137.05 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| ADANIGREEN | 6662742 | 1159.85 | 1164.52 | 1156.00 | 1172.48 | 1181.05 | 1189.65 | 1198.29 |

| MAGMA | 5986685 | 117.90 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| DEEPAKFERT | 4167473 | 184.75 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| INDHOTEL | 2966450 | 122.85 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| CAMLINFINE | 2436993 | 134.70 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| GESHIP | 1774732 | 314.15 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| VIPIND | 1657646 | 400.70 | 405.02 | 400.00 | 409.86 | 414.93 | 420.04 | 425.18 |

| ATGL | 1551014 | 512.20 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| MANGALAM | 852598 | 123.15 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| SYMPHONY | 670856 | 1121.65 | 1122.25 | 1113.89 | 1130.08 | 1138.49 | 1146.94 | 1155.42 |

| KSB | 628763 | 725.25 | 729.00 | 722.27 | 735.40 | 742.19 | 749.02 | 755.87 |

| APLLTD | 627914 | 920.75 | 922.64 | 915.06 | 929.78 | 937.42 | 945.09 | 952.79 |

| GREENPLY | 621009 | 174.75 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| STOVEKRAFT | 472558 | 497.80 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| ATULAUTO | 390179 | 190.60 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| BLS | 366204 | 107.30 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| KIOCL | 359373 | 151.75 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| BLUESTARCO | 332279 | 870.25 | 877.64 | 870.25 | 884.62 | 892.07 | 899.55 | 907.06 |

| NAVINFLUOR | 305649 | 2544.90 | 2550.25 | 2537.64 | 2561.61 | 2574.27 | 2586.97 | 2599.70 |

| OPTIEMUS | 263226 | 171.65 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| THERMAX | 214848 | 1359.35 | 1359.77 | 1350.56 | 1368.32 | 1377.58 | 1386.87 | 1396.19 |

| SRIPIPES | 202772 | 169.45 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| SUNDRMFAST | 174239 | 716.80 | 722.27 | 715.56 | 728.64 | 735.40 | 742.19 | 749.02 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| BHARTIARTL (F&O) | 194887984 | 556.30 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| COALINDIA (F&O) | 94115857 | 152.20 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| TATAMOTORS (F&O) | 91901339 | 322.95 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| SBIN (F&O) | 64450414 | 390.15 | 390.06 | 395.02 | 385.33 | 380.44 | 375.58 | 370.75 |

| ICICIBANK (F&O) | 57349273 | 597.75 | 594.14 | 600.25 | 588.36 | 582.31 | 576.29 | 570.30 |

| ITC (F&O) | 43429293 | 203.85 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| TATASTEEL (F&O) | 23551591 | 715.15 | 708.89 | 715.56 | 702.60 | 695.99 | 689.41 | 682.86 |

| AMBUJACEM (F&O) | 21250569 | 273.50 | 272.25 | 276.39 | 268.27 | 264.19 | 260.15 | 256.13 |

| CANBK (F&O) | 20458137 | 157.20 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| HINDALCO (F&O) | 20379210 | 340.25 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

| ADANIPORTS (F&O) | 19909990 | 675.90 | 669.52 | 676.00 | 663.39 | 656.97 | 650.58 | 644.21 |

| IBULHSGFIN (F&O) | 19284396 | 218.75 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| BPCL (F&O) | 18441539 | 449.85 | 446.27 | 451.56 | 441.22 | 435.98 | 430.78 | 425.60 |

| RELIANCE (F&O) | 17297575 | 2085.80 | 2081.64 | 2093.06 | 2071.29 | 2059.92 | 2048.59 | 2037.28 |

| DLF (F&O) | 16598725 | 302.50 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| ZEEL (F&O) | 15890204 | 201.00 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| SUNPHARMA (F&O) | 15404415 | 594.60 | 594.14 | 600.25 | 588.36 | 582.31 | 576.29 | 570.30 |

| HDFCBANK (F&O) | 13956423 | 1534.40 | 1530.77 | 1540.56 | 1521.76 | 1512.02 | 1502.31 | 1492.64 |

| HDFCLIFE (F&O) | 13122512 | 700.65 | 695.64 | 702.25 | 689.41 | 682.86 | 676.34 | 669.85 |

| BEL (F&O) | 12877803 | 137.10 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| INDUSINDBK (F&O) | 12247085 | 1062.95 | 1056.25 | 1064.39 | 1048.66 | 1040.58 | 1032.53 | 1024.51 |

| HINDPETRO (F&O) | 11918506 | 242.45 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| WIPRO (F&O) | 11731941 | 410.30 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| HCLTECH (F&O) | 9198218 | 909.45 | 907.52 | 915.06 | 900.45 | 892.96 | 885.51 | 878.08 |

| JINDALSTEL (F&O) | 8851273 | 335.90 | 333.06 | 337.64 | 328.68 | 324.16 | 319.68 | 315.22 |