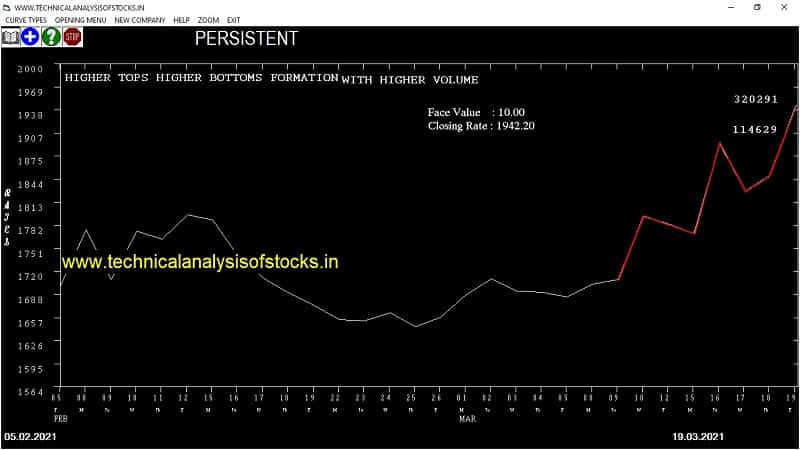

BUY PERSISTENT (NSE Symbol) Buy @ 1947 or Above after cooling period. SIGNAL : HIGHER TOPS HIGHER BOTTOMS FORMATION WITH HIGHER VOLUME. Stop Loss : 1893.20 Target : 1990.40 (Short term)

HOT BUZZING STOCKS (22.03.2021)

NSE SYMBOL CLOSING RATE

SYMBOL RATE

ALICON 501.60

ICRA 3344.25

VIDHIING 189.00

GOLDIAM 353.20

JUSTDIAL 906.75

SCHAND 121.70

ADANIGREEN 1192.60

GANESHHOUC 55.65

ACRYSIL 335.45

EDELWEISS 84.15

RAMKY 79.95

VENUSREM 270.75

JINDALPHOT 58.40

AYMSYNTEX 46.00

ASHAPURMIN 104.65

FSC 79.95

EMAMIPAP 138.10

FLFL 64.60

FRETAIL 55.90

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| DBL | 11653 | 611.10 | 602.50 | 1.43 |

| IPCALAB | 21738 | 1871.00 | 1839.15 | 1.73 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| GODREJIND | 10362 | 517.56 | 489.76 | 540.29 | 517.10 | 518.80 | -0.33 |

| TORNTPOWER (F&O) | 36531 | 430.56 | 405.22 | 451.34 | 425.80 | 429.70 | -0.92 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| EICHERMOT (F&O) | 61847 | 2652.25 | 2715.66 | 2602.30 | 2661.50 | 2610.10 | 1.93 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

TORNTPOWER,429.70%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

GODREJIND,0.33%

TORNTPOWER,0.92%

AAVAS,0.94%

EICHERMOT,1.41%

VEDL,3.42%

HEG,3.45%

NMDC,4.72%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

HARRMALAYA Buy @ 144 or Above

KEI Buy @ 517.55 or Above

INDIAMART Buy @ 8145 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

OPTIEMUS

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

OPTIEMUS

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

CANTABIL

Higher Level Consolidation

CUB (F&O)

DABUR (F&O)

EICHERMOT (F&O)

ULTRACEMCO (F&O)

Lower Level Consolidation

HDFC (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

NIL

GAP DOWN BREAKOUT STOCKS

ASHAPURMIN

EPL

IIFL

INDIAGLYCO

JINDALPOLY

PFC (F&O)

RITES

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

CAMLINFINE

CUMMINSIND

EDELWEISS

GODREJCP

HINDUNILVR

JUSTDIAL

LAURUSLABS

NTPC

RAMKY

UBL

BEARISH ENGULFING

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

ICRA

BEARISH MARUBOZU PATTERN

EMAMIPAP

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

AARTIDRUGS

APTECHT

BAJAJFINSV (F&O)

BPCL (F&O)

CSBBANK

DREDGECORP

GATI

GPPL

HDFCBANK (F&O)

HINDOILEXP

IFGLEXPOR

ITC (F&O)

ITDCEM

JINDALSTEL (F&O)

KAMDHENU

M&M (F&O)

MOTILALOFS

NCLIND

OIL

PFC (F&O)

RADICO

RUPA

SADBHAV

SEQUENT

TATAMOTORS (F&O)

TATASTEEL (F&O)

TVSMOTOR (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ASIANPAINT (F&O)

BATAINDIA (F&O)

BRITANNIA (F&O)

CESC

CHEMCON

DIVISLAB (F&O)

HDFCAMC (F&O)

ITI

JYOTHYLAB

MARKSANS

MARUTI (F&O)

NLCINDIA

PANACEABIO

RIIL

SHALPAINTS

SUNTV (F&O)

ZEEL (F&O)

ZENTEC

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| NIL |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TATAMETALI | 747.20 | 749.39 | 742.56 | 755.87 | 762.76 | 769.68 | 776.63 |

| SRIPIPES | 174.85 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| DALMIASUG | 162.00 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| LUMAXTECH | 153.45 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| SUMICHEM | 280.55 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ITC (F&O) | 134184994 | 222.95 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| TATAPOWER (F&O) | 118996777 | 104.15 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| NTPC (F&O) | 72249183 | 108.50 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| GAIL (F&O) | 42264808 | 138.50 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| POWERGRID (F&O) | 39563112 | 230.20 | 232.56 | 228.77 | 236.27 | 240.13 | 244.02 | 247.94 |

| ASHOKLEY (F&O) | 35938286 | 116.30 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| INDUSTOWER (F&O) | 24883084 | 263.50 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

| TATASTEEL (F&O) | 24637814 | 733.00 | 735.77 | 729.00 | 742.19 | 749.02 | 755.87 | 762.76 |

| CANBK (F&O) | 23896696 | 151.00 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| RBLBANK (F&O) | 19513845 | 228.55 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| RELIANCE (F&O) | 19284892 | 2082.00 | 2093.06 | 2081.64 | 2103.46 | 2114.94 | 2126.45 | 2137.99 |

| ZEEL (F&O) | 16239368 | 215.85 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| L&TFH (F&O) | 14776526 | 101.60 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| IEX | 12679557 | 370.90 | 375.39 | 370.56 | 380.06 | 384.95 | 389.87 | 394.82 |

| JSWSTEEL (F&O) | 11116495 | 440.55 | 441.00 | 435.77 | 446.04 | 451.34 | 456.66 | 462.02 |

| APOLLOTYRE (F&O) | 10788228 | 225.10 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| BANDHANBNK (F&O) | 10449989 | 346.05 | 346.89 | 342.25 | 351.39 | 356.09 | 360.82 | 365.58 |

| TATAMTRDVR | 9446021 | 134.20 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| UPL (F&O) | 8322870 | 625.45 | 631.27 | 625.00 | 637.24 | 643.57 | 649.92 | 656.31 |

| CHOLAFIN (F&O) | 6000233 | 552.85 | 558.14 | 552.25 | 563.78 | 569.73 | 575.71 | 581.72 |

| LICHSGFIN (F&O) | 5752521 | 416.45 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

| HINDUNILVR (F&O) | 5382214 | 2312.05 | 2316.02 | 2304.00 | 2326.90 | 2338.97 | 2351.07 | 2363.21 |

| MEGH | 5151661 | 109.90 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| HINDCOPPER | 4999311 | 125.85 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| ADANIENT (F&O) | 4794995 | 889.65 | 892.52 | 885.06 | 899.55 | 907.06 | 914.60 | 922.18 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| MOTHERSUMI (F&O) | 22347164 | 211.65 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| IIFL | 8379235 | 301.75 | 297.56 | 301.89 | 293.41 | 289.14 | 284.91 | 280.70 |

| DELTACORP | 7031035 | 172.20 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| GICRE | 6611784 | 219.15 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| ABCAPITAL | 3895703 | 120.80 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| EPL | 3705991 | 211.05 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| CASTROLIND | 2933740 | 118.55 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| BRIGADE | 2602362 | 249.60 | 248.06 | 252.02 | 244.26 | 240.37 | 236.51 | 232.68 |

| PVR (F&O) | 2339760 | 1367.60 | 1359.77 | 1369.00 | 1351.24 | 1342.06 | 1332.92 | 1323.80 |

| SONATSOFTW | 1924640 | 470.60 | 467.64 | 473.06 | 462.48 | 457.12 | 451.79 | 446.49 |

| GODREJPROP (F&O) | 1874370 | 1317.75 | 1314.06 | 1323.14 | 1305.67 | 1296.65 | 1287.66 | 1278.70 |

| INDHOTEL | 1860659 | 114.00 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| NH | 1811114 | 385.25 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| GRAPHITE | 1758983 | 507.10 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| ASTRAL | 1673194 | 1671.25 | 1670.77 | 1681.00 | 1661.39 | 1651.22 | 1641.07 | 1630.96 |

| TANLA | 1629977 | 884.70 | 877.64 | 885.06 | 870.69 | 863.32 | 855.99 | 848.69 |

| ERIS | 1513903 | 578.10 | 576.00 | 582.02 | 570.30 | 564.34 | 558.42 | 552.53 |

| INDIGO (F&O) | 1381719 | 1663.60 | 1660.56 | 1670.77 | 1651.22 | 1641.07 | 1630.96 | 1620.87 |

| TRENT (F&O) | 1242150 | 799.20 | 798.06 | 805.14 | 791.41 | 784.39 | 777.40 | 770.45 |

| MAGMA | 1207800 | 116.75 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| INOXLEISUR | 1100758 | 321.30 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| EMAMILTD | 833464 | 471.75 | 467.64 | 473.06 | 462.48 | 457.12 | 451.79 | 446.49 |

| HARRMALAYA | 729578 | 143.30 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| WOCKPHARMA | 710877 | 423.35 | 420.25 | 425.39 | 415.35 | 410.27 | 405.22 | 400.20 |

| BLISSGVS | 707194 | 104.25 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |