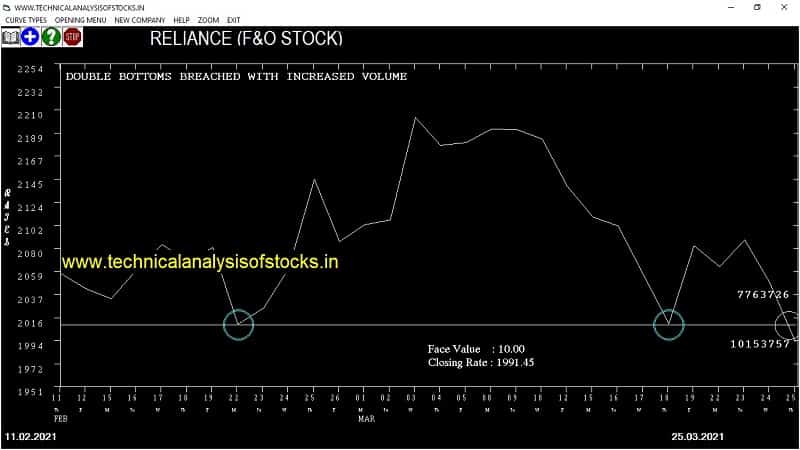

SELL RELIANCE (NSE Symbol) Sell @ 1991.40 or Below after cooling period. SIGNAL : DOUBLE BOTTOMS BREACHED WITH INCREASED VOLUME. Stop Loss : 2046.55 Target : 1948 (Short term)

HOT BUZZING STOCKS (26.03.2021)

NSE SYMBOL CLOSING RATE

XPROINDIA 63.15

BIGBLOC 128.60

EDELWEISS 73.75

ONMOBILE 91.90

FSC 73.60

ADANIPOWER 99.15

ACRYSIL 325.75

OPTIEMUS 130.50

TANLA 814.30

ADANIGREEN 1226.80

PANACHE 65.25

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| ASHOKLEY (F&O) | 127814 | 110.30 | 109.80 | 0.46 |

| OBEROIRLTY | 18094 | 557.30 | 551.90 | 0.98 |

| VOLTAS (F&O) | 67583 | 968.70 | 958.60 | 1.05 |

| EMAMILTD | 12199 | 470.00 | 464.10 | 1.27 |

| TATAELXSI | 25470 | 2646.55 | 2603.45 | 1.66 |

| BORORENEW | 13676 | 250.00 | 245.35 | 1.90 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| POLYCAB | 18658 | 1369.00 | 1323.80 | 1405.55 | 1364.35 | 1379.00 | -1.07 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| LUPIN (F&O) | 35925 | 992.25 | 1031.50 | 961.48 | 992.25 | 988.00 | 0.43 |

| GLAND | 20240 | 2450.25 | 2511.26 | 2402.20 | 2450.60 | 2430.05 | 0.84 |

| IOLCP | 22163 | 570.02 | 599.95 | 546.66 | 570.15 | 564.20 | 1.04 |

| ICICIPRULI (F&O) | 59434 | 425.39 | 451.34 | 405.22 | 430.05 | 425.00 | 1.17 |

| INFY (F&O) | 184200 | 1332.25 | 1377.58 | 1296.65 | 1333.80 | 1313.50 | 1.52 |

| MINDTREE (F&O) | 52179 | 1969.14 | 2023.99 | 1925.98 | 1969.40 | 1938.80 | 1.55 |

| COROMANDEL | 13203 | 749.39 | 783.61 | 722.63 | 752.85 | 740.00 | 1.71 |

| BALKRISIND (F&O) | 27088 | 1600.00 | 1649.57 | 1561.03 | 1606.20 | 1575.50 | 1.91 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

HCLTECH,4.46%

INFY,4.49%

LTTS,6.92%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

POLYCAB,1.07%

VEDL,2.02%

CHAMBLFERT,2.15%

PNCINFRA,2.58%

VBL,2.64%

TCS,2.66%

BALKRISIND,2.73%

COROMANDEL,2.83%

MINDTREE,3.24%

ASIANPAINT,3.24%

LICHSGFIN,3.37%

MPHASIS,3.47%

LUPIN,3.57%

ICICIPRULI,3.67%

MGL,3.72%

SUVENPHAR,4.11%

HAVELLS,4.37%

UTIAMC,4.38%

APOLLOTYRE,4.41%

TORNTPOWER,4.61%

CYIENT,4.85%

PRINCEPIPE,4.87%

GLAND,4.91%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES (Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

UCALFUEL Buy @ 141 or Above

SBICARD Buy @ 930.25 or Above

HAVELLS (F&O) Buy @ 1032 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

SEAMECLTD

SHREEPUSHK

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BALKRISIND (F&O)

COROMANDEL

MPHASIS (F&O)

VEDL (F&O)

Higher Level Consolidation

BALKRISIND (F&O)

COROMANDEL

KSCL

NATCOPHARM

POLYCAB

VEDL (F&O)

Lower Level Consolidation

RAJESHEXPO

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BIGBLOC

GAP DOWN BREAKOUT STOCKS

BPCL (F&O)

CRAFTSMAN

DLINKINDIA

INDSWFTLAB

JAGRAN

KALPATPOWR

LXCHEM

PVR (F&O)

TEXINFRA

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

GDL

GNFC

JUBLFOOD (F&O)

NBVENTURES

TATACOMM

WESTLIFE

XCHANGING

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

ADANIGREEN

EDELWEISS

FSC

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

BAJAJ-AUTO (F&O)

TANLA

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ABFRL

AEGISCHEM

ASTRAMICRO

AXISBANK (F&O)

GHCL

INOXWIND

JAMNAAUTO

JINDALSTEL (F&O)

LALPATHLAB (F&O)

MGL (F&O)

PRESTIGE

UPL (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ASIANPAINT (F&O)

BHARTIARTL (F&O)

CASTROLIND

CROMPTON

DLINKINDIA

EIDPARRY

HDFCLIFE (F&O)

HINDUNILVR (F&O)

IGL (F&O)

IOC (F&O)

JAICORPLTD

KELLTONTEC

MANINDS

MARICO (F&O)

RAJESHEXPO

RBLBANK (F&O)

RECLTD (F&O)

STARCEMENT

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| APLAPOLLO | 1290.60 | 1296.00 | 1287.02 | 1304.36 | 1313.41 | 1322.48 | 1331.58 |

| ORIENTELEC | 303.75 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| MPHASIS (F&O) | 1673.10 | 1681.00 | 1670.77 | 1690.42 | 1700.71 | 1711.03 | 1721.39 |

| GUJGASLTD (F&O) | 511.85 | 511.89 | 506.25 | 517.30 | 523.00 | 528.74 | 534.50 |

| DRREDDY (F&O) | 4380.55 | 4389.06 | 4372.52 | 4403.44 | 4420.04 | 4436.67 | 4453.33 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| HERANBA | 628.95 | 625.00 | 631.27 | 619.08 | 612.87 | 606.69 | 600.55 |

| DHAMPURSUG | 185.35 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| WABCOINDIA | 5643.20 | 5625.00 | 5643.77 | 5609.07 | 5590.36 | 5571.68 | 5553.03 |

| LTTS (F&O) | 2492.55 | 2487.52 | 2500.00 | 2476.30 | 2463.87 | 2451.48 | 2439.11 |

| LALPATHLAB (F&O) | 2462.70 | 2462.64 | 2475.06 | 2451.48 | 2439.11 | 2426.78 | 2414.47 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| TATASTEEL (F&O) | 36722400 | 723.15 | 729.00 | 722.27 | 735.40 | 742.19 | 749.02 | 755.87 |

| DCBBANK | 2043508 | 104.50 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| DALMIASUG | 662164 | 175.90 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| KAJARIACER | 506744 | 899.30 | 900.00 | 892.52 | 907.06 | 914.60 | 922.18 | 929.78 |

| ALKEM (F&O) | 476707 | 2640.35 | 2652.25 | 2639.39 | 2663.81 | 2676.72 | 2689.67 | 2702.65 |

| NATCOPHARM | 429375 | 818.20 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| GPIL | 398437 | 712.85 | 715.56 | 708.89 | 721.90 | 728.64 | 735.40 | 742.19 |

| HOMEFIRST | 323493 | 465.70 | 467.64 | 462.25 | 472.83 | 478.28 | 483.76 | 489.27 |

| AEGISCHEM | 261064 | 287.75 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| PRIVISCL | 191715 | 814.50 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| ERIS | 171565 | 605.20 | 606.39 | 600.25 | 612.26 | 618.46 | 624.69 | 630.95 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| TATAMOTORS (F&O) | 84528317 | 285.55 | 284.77 | 289.00 | 280.70 | 276.53 | 272.39 | 268.27 |

| ITC (F&O) | 40681282 | 211.60 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| ONGC (F&O) | 37295495 | 102.00 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| ASHOKLEY (F&O) | 35580407 | 109.80 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| CANBK (F&O) | 33493070 | 143.40 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| MOTHERSUMI (F&O) | 25635148 | 196.05 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| NTPC (F&O) | 22543755 | 103.00 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| IBULHSGFIN (F&O) | 21311729 | 195.60 | 192.52 | 196.00 | 189.16 | 185.73 | 182.34 | 178.98 |

| BEL (F&O) | 20239483 | 119.25 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| GAIL (F&O) | 20151971 | 128.00 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| RBLBANK (F&O) | 18673108 | 210.05 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| COALINDIA (F&O) | 18629600 | 128.10 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| BHARTIARTL (F&O) | 17248482 | 507.75 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| ADANIPORTS (F&O) | 16860086 | 688.25 | 682.52 | 689.06 | 676.34 | 669.85 | 663.39 | 656.97 |

| ZEEL (F&O) | 14877598 | 196.10 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| ADANIENT (F&O) | 13139164 | 981.55 | 976.56 | 984.39 | 969.25 | 961.48 | 953.74 | 946.04 |

| WIPRO (F&O) | 12737129 | 399.65 | 395.02 | 400.00 | 390.26 | 385.33 | 380.44 | 375.58 |

| POWERGRID (F&O) | 11403073 | 216.40 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| M&MFIN (F&O) | 11277994 | 196.05 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| NMDC (F&O) | 11022213 | 124.05 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| UPL (F&O) | 10648953 | 595.65 | 594.14 | 600.25 | 588.36 | 582.31 | 576.29 | 570.30 |

| BPCL (F&O) | 10449487 | 418.95 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| DLF (F&O) | 10184085 | 277.00 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| RELIANCE (F&O) | 10153757 | 1991.45 | 1991.39 | 2002.56 | 1981.24 | 1970.13 | 1959.04 | 1947.99 |

| BANDHANBNK (F&O) | 8907893 | 349.95 | 346.89 | 351.56 | 342.42 | 337.81 | 333.23 | 328.68 |