Every stock trader in the marketplace globally that I know, they all have just one objective- to make money. However, very few people are able to successfully make money in the long run. When the market is rallying up, almost every earns money by trading stocks. However when push comes to shove during the bearish season; they take along with them almost all the profits of unsuspecting investors.

Stock analysis is an art that requires skills . If a stock trader is not watching his emotional attachment to certain stocks, he’ll definitely get his fingers, if not his life burnt. To avoid such mishaps, it is important that he imbibes every analyzing tools that are vitally necessary for his success. well in the art of analyzing and picking profitable stocks, one does not need a Harvard or Cambridge ability or knowledge to do well, all you need is four simple tools, what will be extensively explained in other parts of subsequent articles of this series, What the average prospective stock investor needs are

- Common sense

- A good sense of history

- A good sense of arithmetic… arithmetic is the branch of mathematics that deals with subtraction and addition.

- Sound trading skills.

How can one know which stocks will make profits in the stock market? How can you be sure that the stocks you are investing your money into will not burn your fingers? Such questions are tough to answer if you don’t know your way through the uncertain road of stock’s investment. To be at home with analyzing hot stocks that can crank fortunes into your bank account, you must be able to cultivate the ability to think straight; you must be disciplined when it comes to controlling your emotions, as a stock analyst of almost ten years standing, I’ve seen men destroyed because they could not separate their feelings from the reality that was starring them in the face.

Stocks analyzing discipline can be achieved with strict money management discipline. Every investor must be able to acquaint himself with basic stock analyzing tools like common sense, which enables you to be able to think rationally. This is intended to open the eyes of the investor to objective analysis to show him how to identify stocks for trading. How to subtract falsehood in terms of companies that don’t have strong fundamentals and add up sound facts based on sound technical and fundamental realities, When an investor is not familiar with the performance of companies in the previous years, he can fall into the trap of repeating a sad history of loses. A good sense of past performance can save a stock trader from basing their investment on guesswork or flimsy rumours that holds no water.

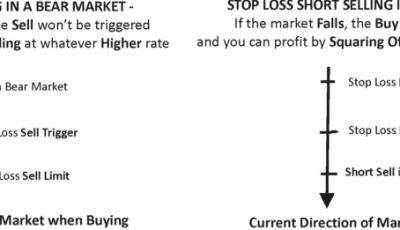

Stock trading is believed to be risky by certain category of investors and such people are intimidated to go into trading, Risk no matter how risky it is, can be reduced to the barest minimum by knowledge, a sound knowledge of the dynamics of equity investment will be of life help to you ultimately.

You must understand that it is investor’s sentiment that drives the prices of stocks. Your ability to know what is responsible for these sentiments, why investors respond to certain stocks the way they do is very critical to your analyzing skills.