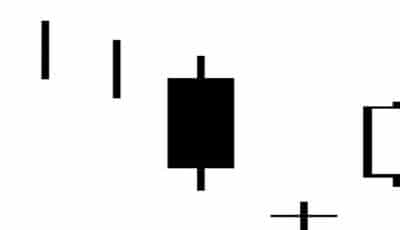

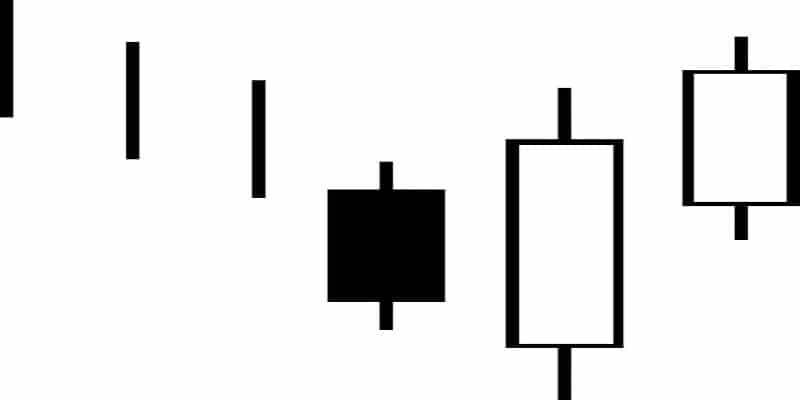

Are you waiting for a stock to hit rock bottom? If so, you should be watching for the three outside down candlestick pattern. This formation is a reversal signal that no smart trader will ignore. It begins in the midst of a long downturn. The market has been falling for a while, and the long black candlestick of the first day of this candlestick pattern is a continuation of this downward trend. However, while the second day opens low, it then moves steadily upward through the day, ending with a closing price that is well above the first day’s starting point, creating a long white candle and pointing to a possible reversal. The third day confirms the reversal suggested by the first two days, with another long white candlestick and an even higher close.

When this pattern occurs in a downturn, it is a strong indicator of a reversal—in fact, it is often considered an undeniable and completely solid indicator under these circumstances. The white candle on the second day could be a fluke, but the third day’s high close proves that there is no more room for falling prices when it comes to this stock. The market has hit its bottom-most point and is ready to make a strong rebound. The only question is whether you will stand to profit from this bullish reversal.

Your Next Move

Your next move should be to buy into the market immediately. It’s easy to see that prices have nowhere to move but upward, allowing you and any other traders wise enough to recognize this pattern the chance to maximize profits. Because this pattern is considered confirmation of another two candlestick pattern, no confirmation is really needed. However, if market forces seem to indicate further downward movement, you can wait for confirmation on the fourth trading day.

Confirmation

The three outside up candlestick pattern is considered confirmation of a reversal in and of itself. However, if you want further confirmation, look for a white candlestick of any kind, a gap up at the opening of the fourth trading day, or a higher close.

Variations

The wicks of the candlesticks of all three days may be of any length, although they are most commonly short or even nonexistent altogether. The candlesticks themselves also may vary in length; it is their relative length to each other that makes them fit this pattern.

Similar Patterns

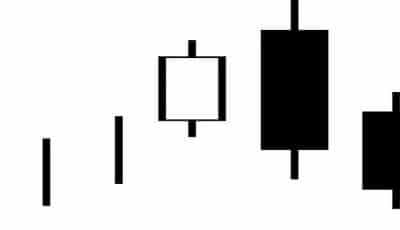

The first two days of the three outside up candlestick pattern form the bullish engulfing candlestick pattern, which is in and of itself a strong indicator of a reversal. The third day’s white candle can serve as confirmation of the indicated reversal, making the three candlestick pattern even stronger.

In short, the three outside up candlestick pattern is a chance—a chance to invest in a market that is sure to be on its way up in the very near future. Don’t get left out of this windfall; when you see three outside up, act for a bullish market.