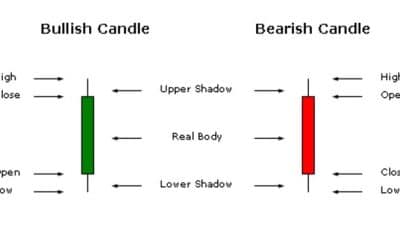

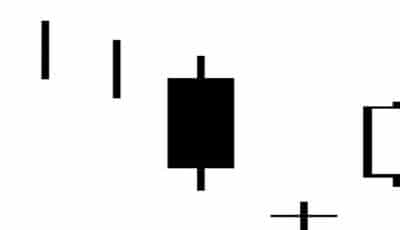

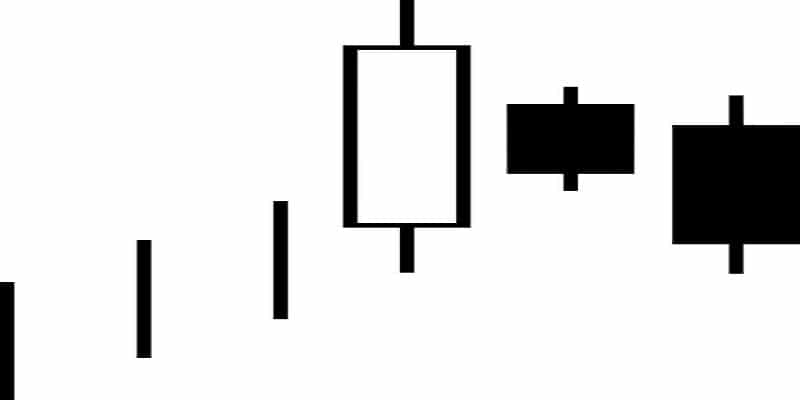

The three inside down candlestick pattern signals the end of one trend and the beginning of another. The movement that is about to end is a bullish uptrend that sets the stage for this formation. The first day of the pattern has a long white candle that seems at first to be a continuation of the bullish market.

However, the day has a short black candlestick that opens below and closes above the first day’s body. The third day continues the bearish turn with another black day that closes below the first day’s opening. None of the days have significant wicks, and the wicks may be absent altogether.

What this means for traders is that the market is not about to turn, but actually turning. On the first day, we witness the last day of the bull dominated market. On the second and third days, the bears begin to gather momentum and take over the day. There is no need for a fourth day or any other confirmation, because that confirmation has already been provided.

Your Next Move

Because this pattern is a very reliable one, you can sell or make other decisions based on a bearish market without any reservation. The third day is usually considered enough confirmation of the reversal, and this confirmation is increasingly strong if there is a particularly long black candle or an especially low close on that important day. However, if you feel uncomfortable acting immediately, you can plan for your next move while waiting for the fourth trading day.

Confirmation

Confirmation on the fourth day could include any kind of bearish move. This could entail a gap down, another low close, or a long black candlestick. When these occur, it’s important to act immediately.

Variations

This candlestick pattern is very similar to the three outside down candlestick pattern, and not just in name only. The key difference lies in the relative length of the first two days’ candlestick bodies. In the three inside down pattern, the first day engulfs the second, while in the three outside down the second day engulfs the first. However, both patterns have the same basic meaning: that a downturn is on the way and may already actually be in effect.

Similar Patterns

One similar pattern is the bearish harami pattern, which like the three inside down pattern has a long white day that engulfs a shorter black day. However, the three inside down pattern has that all important third day that basically confirms the bearish harami. This is why this is considered such a reliable pattern; it provides its own confirmation on the third day, making it inarguably clear that the bears are taking over.

The three inside down pattern is one that no wise trader ignores. The two black days are a clear indication that it is time to sell, if you haven’t already. By looking for and acting on this and related candlestick patterns, you can maximize profits by catching on to downtrends earlier than ever.