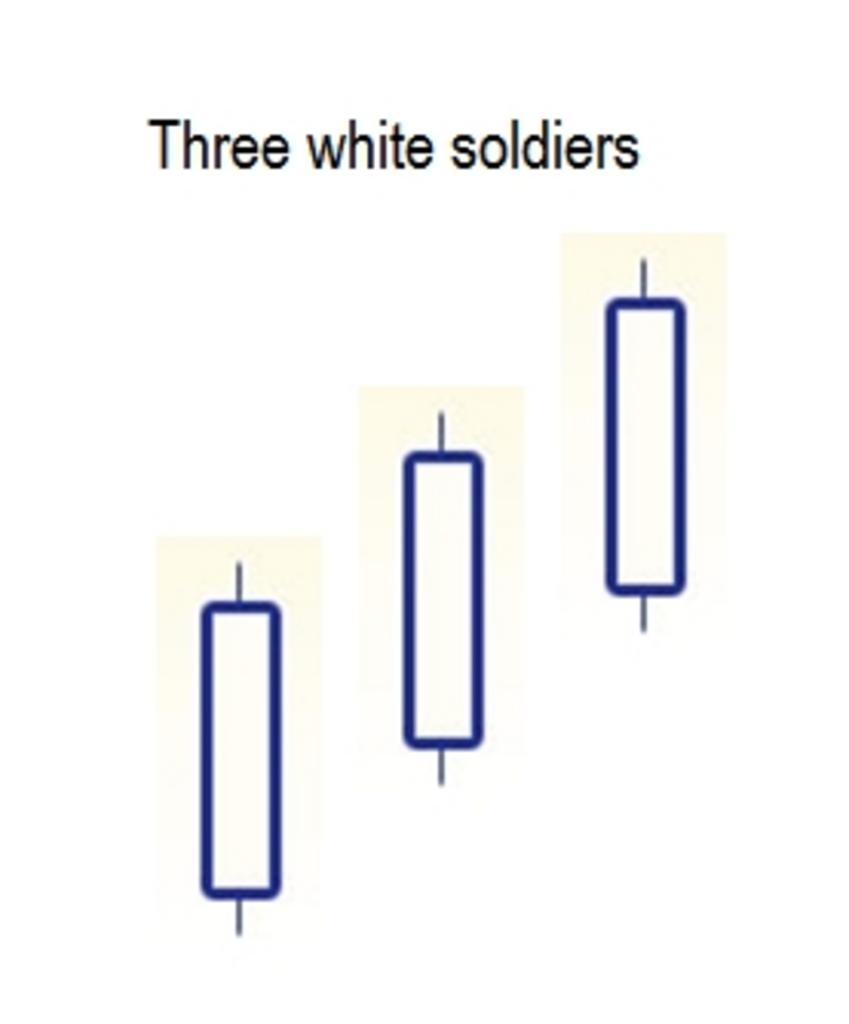

The three white soldiers candlestick pattern is an unusual one because its significance depends on its context. However, the pattern itself is easy enough to recognize. This formation simply consists of three consecutive days with a white candle, each higher than the last. The appearance is of three white soldiers standing in a row, hence the name. The bullish significance of this formation is easy to guess. However, how reliable is this indicator?

This indicator is actually quite potent and highly reliable in most situations, pointing toward a gathering of bullish strength. For instance, if a market has been stagnant or having mainly sideways movement, the three white soldiers indicate that the bulls are taking over. If the market has been mired in a downtrend, this candlestick pattern indicates a reversal. However, if the market has been steadily moving upward, the three white soldiers are considered less significant. This is because they are consistent with the current pattern and not really considered even a continuation.

Your Next Move

Your next move when you see this pattern during a bearish or sideway market should be to plan for an upturn. If the market has been in a downtrend, this is a particularly good time to buy. If it has been moving sideways, the same recommendation applies. However, if the market has been moving upward already, you should examine other indicators to determine the best course of action. Of course, waiting for confirmation on the fourth trading day is always a good idea, especially if other factors are pointing toward a downturn or further sideways movement.

Confirmation

Confirmation of the three white soldiers could include any kind of upward movement, whether that is a white candlestick on the fourth trading day, another gap up, or any kind of generally higher close. However, in this case, waiting for confirmation may mean a slight reduction in profits.

Variations

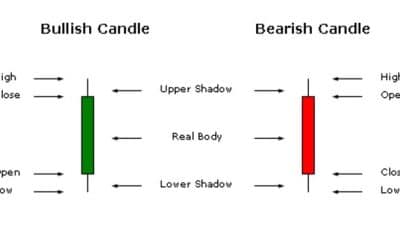

One variation on this pattern lies in the shadows. Generally, this pattern by definition includes either very small shadows or even none at all. Another variation lies in the length of the candlesticks themselves as well as the degree to which they overlap each other. For the most part, the more upward movement you see, the more you can count on a bullish future for this stock.

Similar Patterns

The three white soldiers candlestick formation is nearly the exact opposite of the three black crows formation. Because these formations are opposites of each other, they indicate the exact opposite futures; while the three black candlesticks of the three black crows point to bearish movement, the three white soldiers indicate that the bears are ruling the day.

Are you scanning the market everyday for signs of upward movement? If so, the three white soldiers should be your best friends. With these men on your side, there is truly nowhere to go but up. This strong indicator is one formation that every wise trader should be on the lookout for.