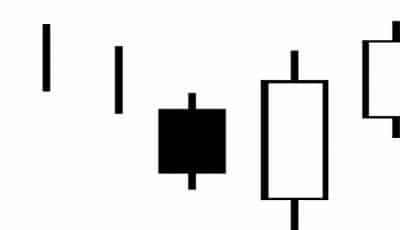

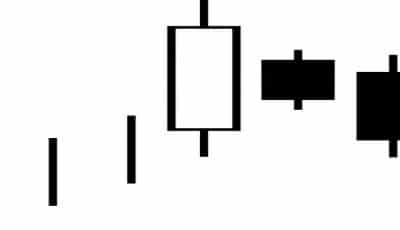

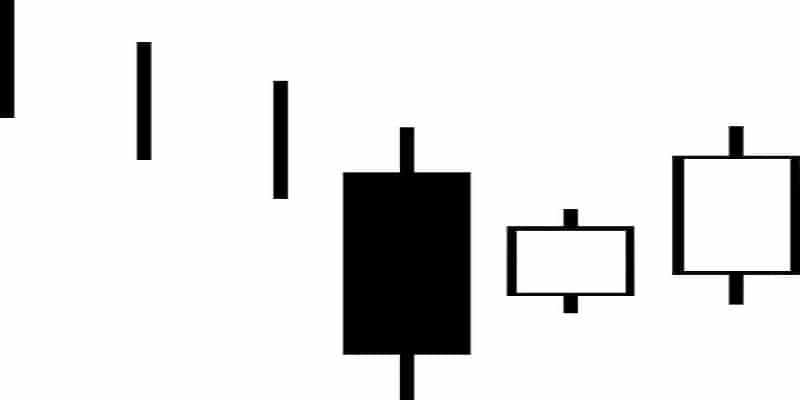

Are you waiting for the buyers to take over a market? If so, look out for the three inside up candlestick pattern! An indicator of a turnaround in fate, this formation begins during a general downturn. The first day has a long black candlestick that seems to confirm this. However, the second day shows that the bears are losing vigor with a long white candle that, while beginning rather low, trades up throughout the day until it reaches the midpoint of the candle from the first day. The third day is another white candlestick day, one which pushes the price above the opening of the first day altogether.

As you can probably guess, the three inside up candlestick pattern is a bullish reversal of a bearish trend. You can clearly see the stock reach the floor, rebound, and begin to travel back up. This is one candlestick pattern that is easy to read because its meaning matches its pattern precisely.

Your Next Move

Your next move should be to buy into this market before it is veritably flooded with buyers. Because the third day confirms the first two, this is considered a very reliable indicator of a reversal. However, if you decide to wait for confirmation, it will likely present itself on the fourth trading day.

Confirmation

Confirmation of the three inside up candlestick pattern can consists of any kind of upward movement on the fourth trading day, such as a white candlestick of any kind, a high close, or a sizeable gap up. In general, however, confirmation is not considered necessary.

Variations

One variation of three inside up lies in how the candles are positioned next to each other. For example, this candlestick pattern is even stronger if the third day’s candle closes above the first day’s opening, creating an all time high for the previous three days. Generally, if upward movement dwarves the downward movement, you know that you have a stock that is about to take off.

Similar Patterns

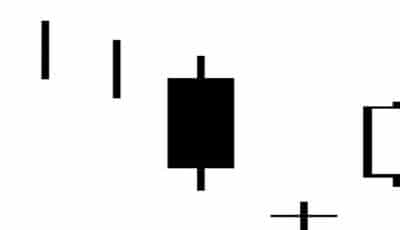

The first two days of the three inside up candlestick pattern is also known as a bullish harami pattern. The third day of the three inside up merely confirms that upturn that this pattern indicates. This makes three inside up a very effective indicator,

Three inside up is very similar to the three outside up candlestick pattern. The key difference is that the second day does not completely engulf the first. Regardless, they are both excellent indicators of a bullish reversal, a message that should be taken seriously by anyone who wants to earn money.

If you are waiting for a sign, a chance to make money in the stock market, the three inside up candlestick pattern may be just the ticket. This pattern makes it easy for you to see a rebound before it happens, and therefore gives you a chance to get in while there is nowhere to go but up. That’s an opportunity that no one can afford to pass up!