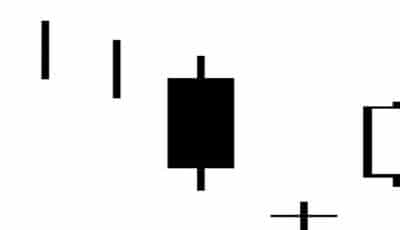

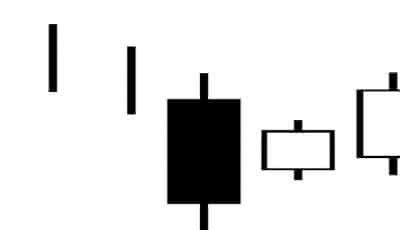

The three outside down candlestick pattern occurs during a bullish market. It begins with a short white candlestick on day one, but the second day comes with a surprise. There is a long black candlestick with a body that extends both above and below the previous day’s white candlestick, completely engulfing it. The third day is another bearish day with a black candlestick that closes even lower than the first day. The wicks on all three days are either small or nonexistent.

Because the second day begins above the first and closes far below, there clearly are signs of an impending reversal. If there is any ambivalence, the third day’s low close only confirms the coming downturn by adding a second black day. Clearly the sellers have managed to break the buyers’ momentum and take the day for themselves. This is likely the very beginning of a long bearish trend.

Your Next Move

Many traders consider the third day of the three outside down candlestick pattern to be confirmation enough. This is a highly reliable indicator and suggests the need to sell or otherwise act based on a down market. However, if you want to wait for confirmation it likely will present itself on the fourth trading day. A fourth day rarely does any harm, but waiting can keep you from acting too hastily.

Confirmation

If you are waiting for confirmation, any kind of bearish move will suffice. There should be a gap down, a black candlestick, or any kind of lower close on the fourth trading day. When you see these, it is time to act immediately as the downturn is already in progress.

Variations

One important variation of this pattern is the general context in which it occurs. In general, the stronger the upturn preceding the three outside down pattern, the more likely it is to be a sign of a reversal. In an ambivalent or unsteady market, this formation is less significant. Another variation is the length of the black candlesticks of the second and third days. Generally, the longer the candlesticks and the lower their close, the more indication they are of a turnaround.

Similar Patterns

Do the first two days of this pattern look familiar? It may be because the first two days of the three outside down candlestick pattern is actually the two stick bearish engulfing candlestick pattern. This two candlestick pattern requires confirmation, and the long black candlestick of the third day of three outside down is the necessary confirmation. This is why the three outside down candlestick pattern is such a strong indicator. It provides its own confirmation on its own third day.

This is a very reliable pattern, and in fact the confirmation of a moderately reliable two day pattern. As such, a wise trader will move immediately upon seeing that third candlestick. Don’t let this opportunity to sell high pass you by; pay attention to the valuable warning that the three outside down candlestick pattern is giving you.